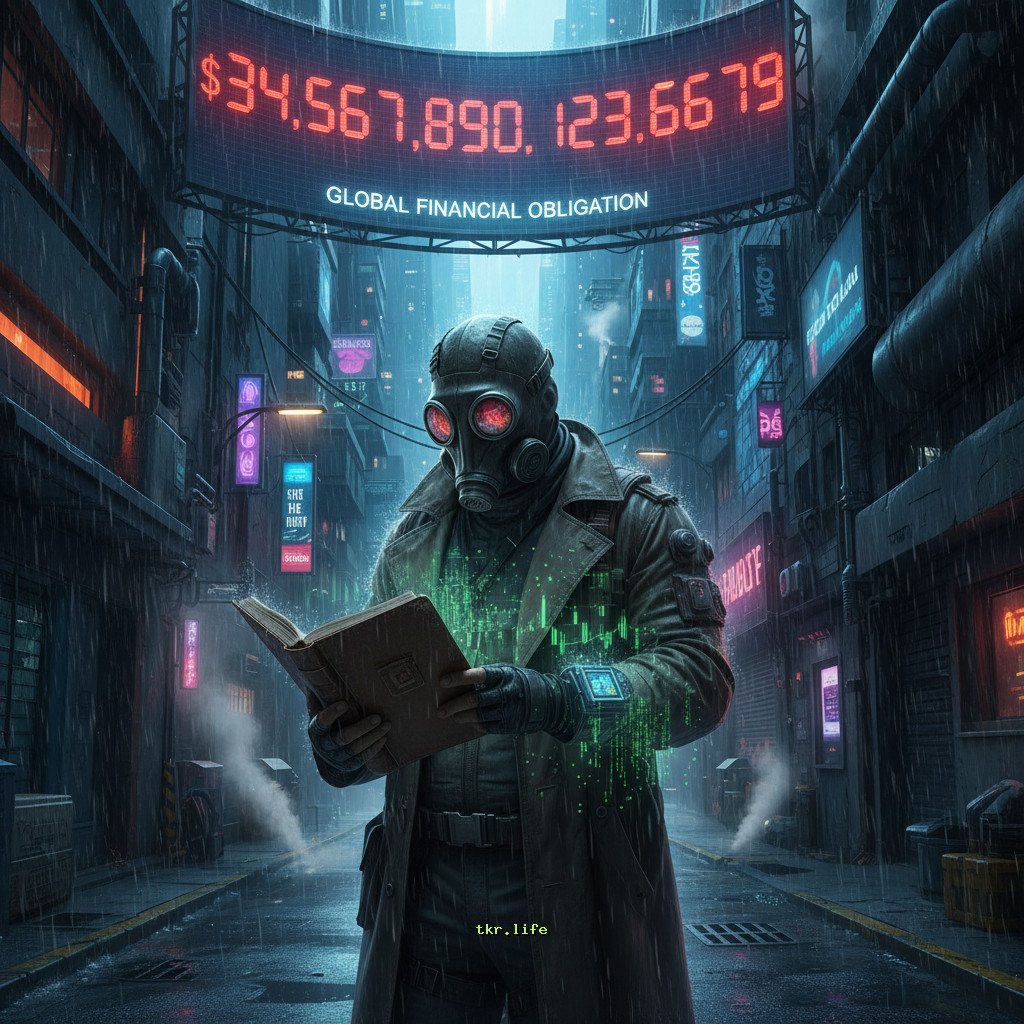

The Inevitable Bill, Postponed

The whispers start subtly: ‘Consider tax-advantaged accounts,’ they murmur. ‘Defer those gains,’ they suggest. You pat yourself on the back for clever maneuvering, for kicking the can down the road. You’ve ‘optimized.’ But optimization, without cold, hard clarity, is just self-deception.

Every delayed tax liability is a phantom limb growing heavier. It’s not gone; it’s accruing interest, compounding silently in the background. It’s a debt to the future, and the future always collects. The game isn’t about avoiding the taxman; it’s about understanding the game board.

This delay isn’t free. It’s an illusion of control, a temporary reprieve bought with future uncertainty. The underlying problem – the need to generate value – remains unaddressed. Instead, you’ve layered complexity, making the eventual reckoning more opaque, potentially more devastating.

Think. Are you truly building wealth, or just erecting a precarious scaffolding of deferrals and deductions? Is your strategy designed to withstand the storms of market volatility and legislative changes, or will it collapse under the weight of its own deferred obligations?

- Assess your actual tax burden, today and projected.

- Understand the mechanisms of compounding interest and the eroding effect of inflation on future payments.

- Question the advice that encourages perpetual deferral. Is it truly aligned with your long-term well-being, or simply maximizing short-term gains for someone else?

Time is finite. Value is finite. The taxman is patient, but he is also relentless. Don’t mistake cleverness for wisdom. Confront the inevitable. Plan. Prepare. Or be consumed by the future you so eagerly delayed.